Present value of lease payments excel

Export amortization schedules to Microsoft Excel and Word and to PDF CSV and XML with one-click. The present value of the lease payments is greater than or equal to 90 of the assets fair market value.

How To Calculate The Present Value Of Future Lease Payments

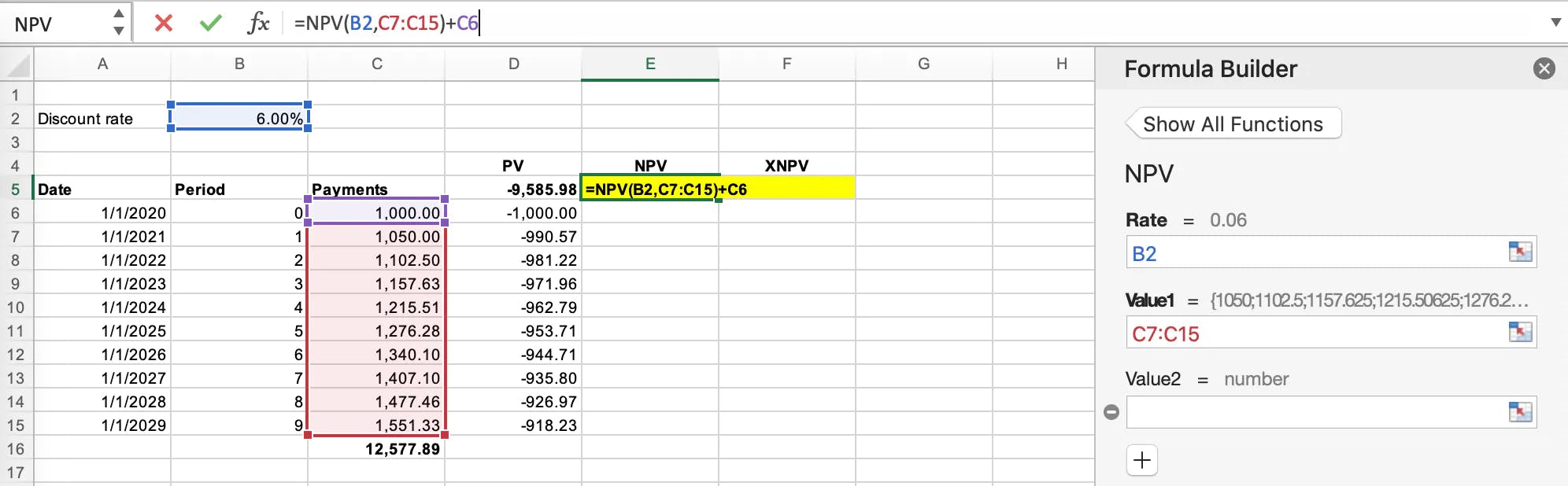

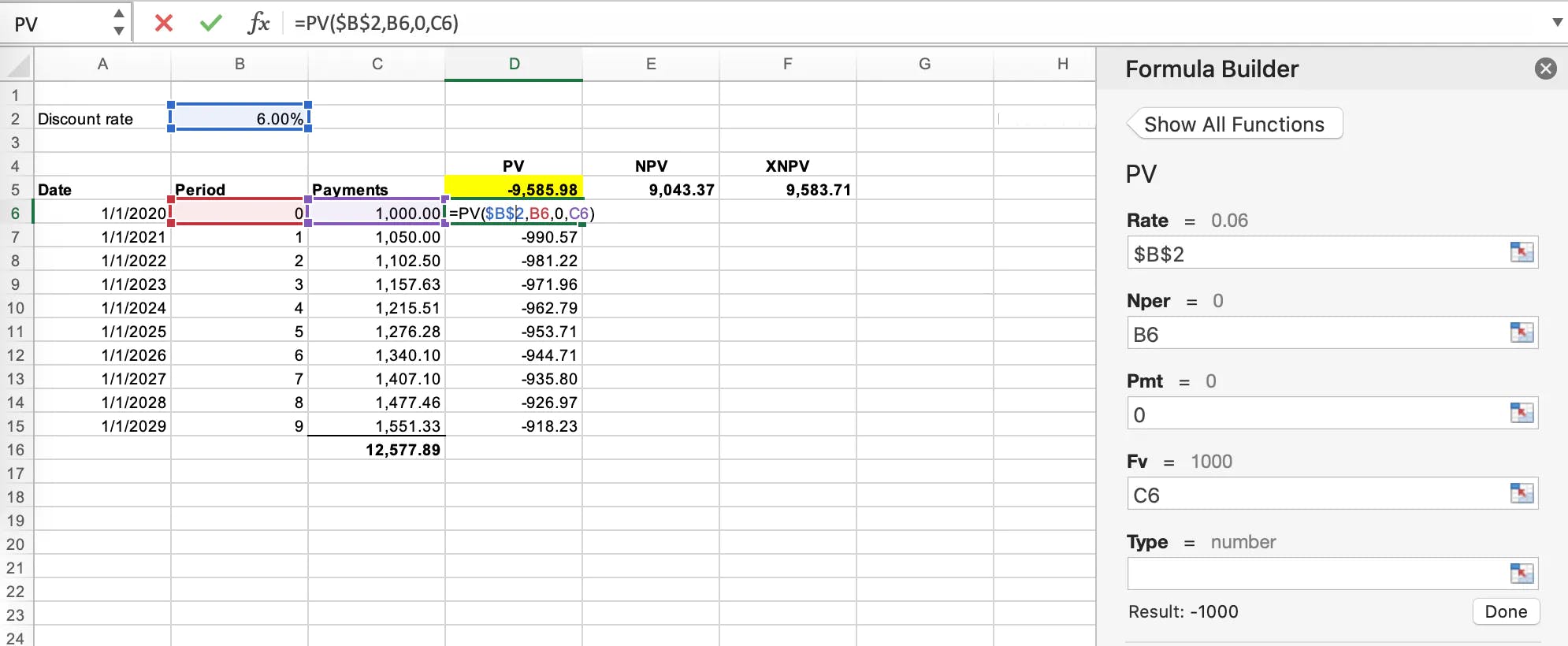

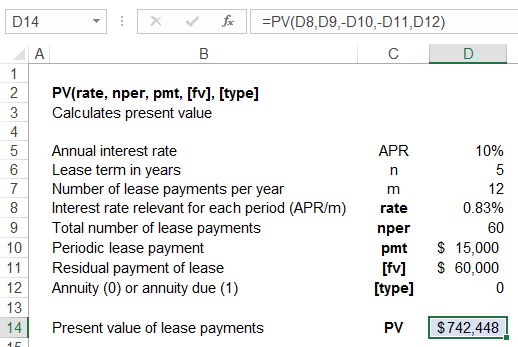

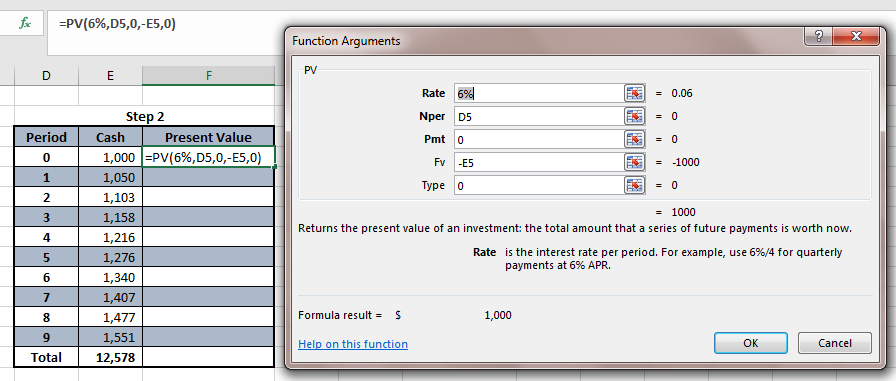

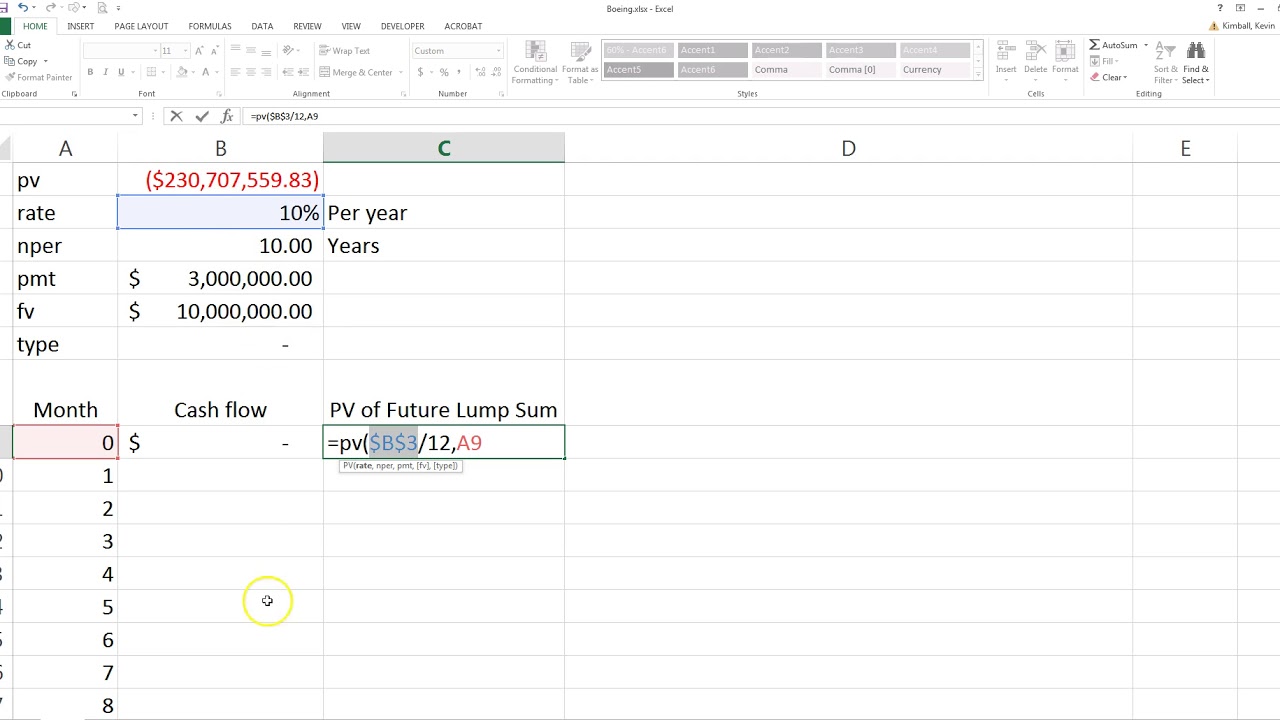

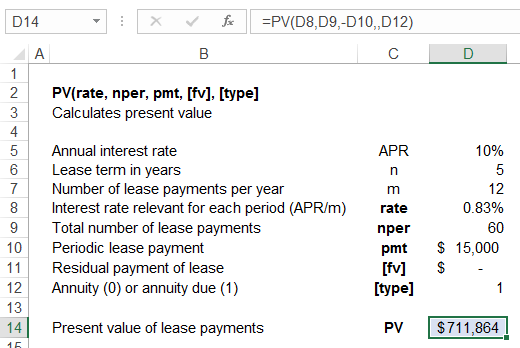

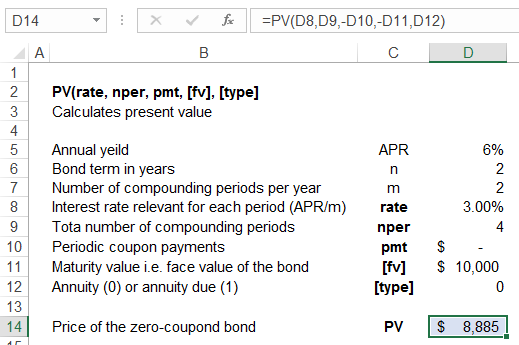

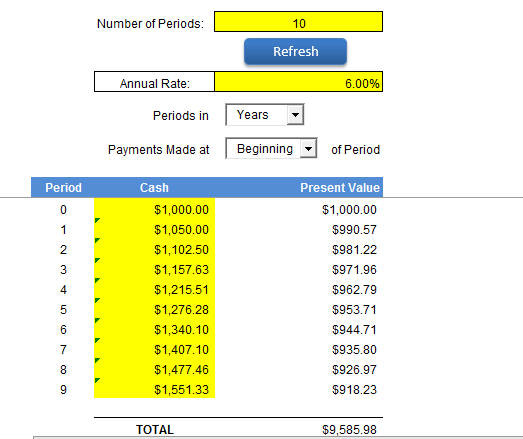

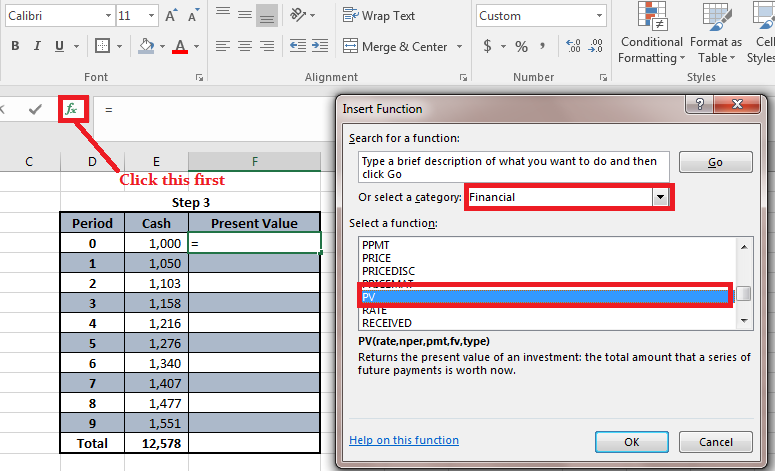

Present value can be calculated relatively quickly using Microsoft Excel.

. A lease is a method of financing the use of an asset and is an agreement between a lessee who rents the asset and a lessor who owns the asset. In case of a loan its simply the original amount. Initially the company creates a Lease Asset based on the Present Value of the lease payments over the next 10 years.

Taking the impact of the depreciated value the monthly lease payment Monthly Lease Payment Lease payments are the payments where the lessee under the lease agreement has to pay monthly fixed rental for using the asset to the lessor. Example of Lease Rate Calculation. Initial direct costs paid in cash are CU 3 000.

CR Lease Liability 136495. Once these payments are present valued this will be the value of the lease liability. FAST tools are a collection of installable Microsoft Excel Spreadsheets for a wide range of agricultural management and finance tasks.

This lease is a finance lease for two reasons. Exhibit 3 shows the lease accounting. The payment of the related interest was CU 491.

In 20X4 amortization of ROU asset was CU 4 000. The present value of the lease liability is CU 17 000. It also creates a corresponding Lease Liability based on the same calculation.

Master excel formulas graphs shortcuts with 3hrs of Video. 1 the lease term represents 100 of the useful economic life of the underlying asset and 2 the present value of the lease payments equals the fair value of the underlying asset. Under the new lease accounting standards lessees are required to calculate the present value of any future lease payments.

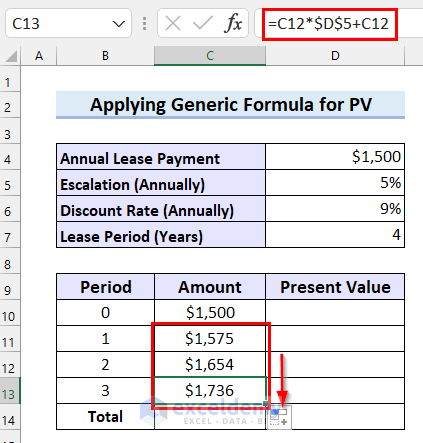

Equals the residual value 13110. Go to Download Car Buy vs Lease Calculator for Excel. The formula for calculating PV in Excel.

The term of the lease is greater than or equal to 75 of the useful life of the asset. In this example it is 12 payments of 10000 occurring on the first day of each month starting on 2021-1-1 to 2021-12-1. Examine how much a firm should return to investors and in what form dividends versus buybacks.

Worksheet to compute net present value compare price and terms evaluate IRR. Commercial Leasing The lease rate is primarily applicable for. A positive value means the Difference is in favor of leasing while a negative value is in favor of buying.

Evaluates insurance payments and provides historical data useful when making crop insurance decisions for multiple crops. Fixed at 20 per year. How to Calculate a Lease Rate.

The lease payments due at Dec. Present value commonly referred to as PV is the calculation of what a future sum of money or stream of cash flows is worth today given a specified rate of return over a specified period of time. The rate of interest that at a given date causes the aggregate present value of a the lease payments and b the amount that a lessor expects to derive from the underlying asset following the end of the lease term to equal the sum of 1 the fair value of the underlying asset minus any related investment tax credit retained and expected.

The lessor is usually a lease company or finance company. Lessee will record the fair value present value of min lease payments of the asset on lease at both the asset and liability sides of the balance sheet. The total amount that all future payments are worth now.

The repayment of the lease liability was CU 3 209. 5 this is close to the rate the company would pay on secured debt. At the end of the table you can see that the template automatically computes for the Difference with a Note to guide you.

For example if you make annual payments on a 5-year loan supply 5 for nper. Sticker price MSRP of the car. Present value of lease payments explained.

Lease or solve any time value of money calculation Videos. The TValue Family of Solutions. Times the residual value percentage.

If you would like more information on what payments should be included in the present value calculation for a finance lease refer here. The present value of lease rentals is equal to or greater than the assets fair market value. The template also features Taxation Data.

The equipment account is debited by the present value of the minimum lease payments and the lease liability account is the difference between the value of the equipment and cash paid at the beginning of the year. The calculator uses the monthly lease payments formula based on the present value of an annuity as follows. Alternatively if evaluated under IFRS there is one more criterion that can be used to qualify a lease as a capital lease.

Estimate risk in an investment and its hurdle rate as well as assess investment returns net present value internal rate of return accounting return Evaluate the right mix of debt and equity in a business and the right type of debt for a firm. Pv required - the present value ie. If you make monthly payments on the same loan then multiply the number of years by 12 and use 512 or 60 for nper.

From a simple loan payment to a present value of an intricate series of irregular cash flows the calculation logic is built into the program. During 20X4 ABC paid the lease payments in total amount of CU 3 700 thereof. Negotiated selling price of car.

Present value PV is the current value of an expected future stream of cash flow.

How To Calculate The Present Value Of Future Lease Payments

How To Calculate The Present Value Of Lease Payments In Excel

Calculating Present Value In Excel Function Examples

How To Calculate The Present Value Of Lease Payments Excel Occupier

How To Calculate The Present Value Of Lease Payments In Excel

Present Value Calculator Occupier

Using Excel To Calculate Present Value Of Minimum Lease Payments Thebrokerlist Blog

Compute The Present Value Of Minimum Future Lease Payments Youtube

Compute The Present Value Of Minimum Future Lease Payments Youtube

Calculating Present Value In Excel Function Examples

Calculating Present Value In Excel Function Examples

:max_bytes(150000):strip_icc()/Clipboard01-618bfd11c29a4e2dbd2a50ea127f34d1.jpg)

Present Value Excel How To Calculate Pv In Excel

Using Excel To Calculate Present Value Of Minimum Lease Payments Thebrokerlist Blog

How To Calculate A Lease Payment In Excel 4 Easy Ways

Using Excel To Calculate Present Value Of Minimum Lease Payments Thebrokerlist Blog

How To Calculate The Present Value Of Lease Payments Excel Occupier

Using Excel To Calculate Present Value Of Minimum Lease Payments Thebrokerlist Blog