37+ how many hard inquiries for mortgage

To the extent an inquiry does cause you to have a lower score the. Ad Learn More About Mortgage Preapproval.

Does Applying With Multiple Mortgage Lenders Affect Credit Score

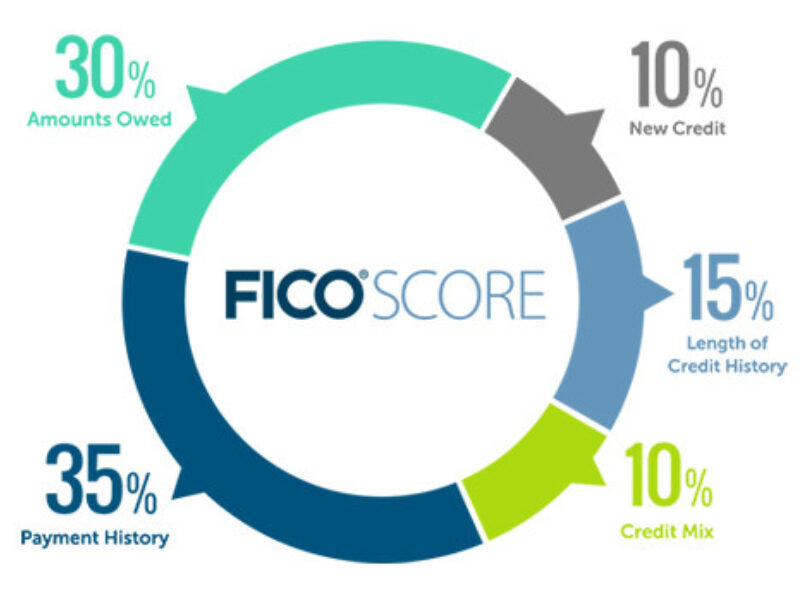

Web Hard inquiries are one of the five major factors that make up your credit score.

. After that they will not approve you no. Web The average consumer is expected to acquire one or two hard inquiries a year. Ad Are you eligible for low down payment.

Each lender typically has a limit of how many inquiries are acceptable. Web Keep your hard inquiries to one or two a year. Web A single hard inquiry can shave up to 5 points off your FICO score.

For example lets say you shopped for a mortgage with. Browse Information at NerdWallet. Web For many lenders six inquiries are too many to be approved for a loan or bank card.

Depending on your existing credit history these might drop your score by a handful. Find A Lender That Offers Great Service. Web In other words FICO treats similar loan-related inquiries within 14 days of each other as a single inquiry.

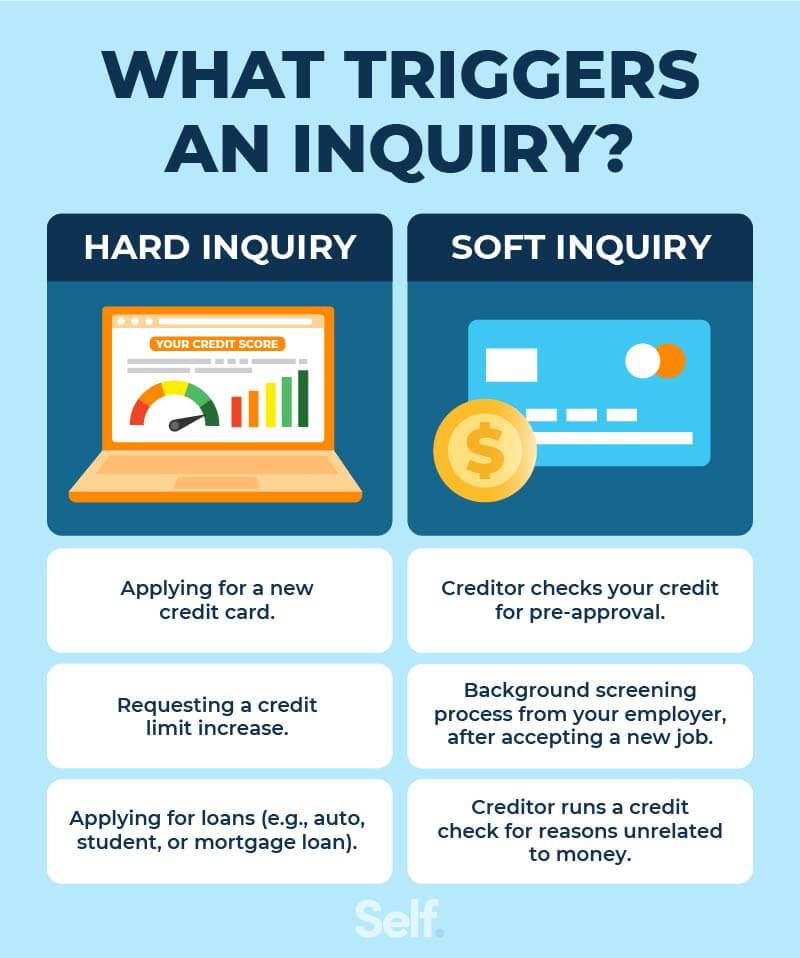

Web In general adding one or two hard inquiries to your credit reports could lower your scores by a few points but its unlikely to have a significant impact. Web Hard inquiries make up 10 of your credit score and can hurt your credit score by up to 10 points regardless of whether you get the loan. Web Shopping for auto student or home financing within a short time frameusually 14 to 45 dayscould be treated as just a single hard inquiry.

Web Equifax no baddies. Find all FHA loan requirements here. Save Real Money Today.

Based on the data this number corresponds to. In general six or more hard inquiries are often seen as too many. Whether you pay your bills on time and as.

If you apply for a mortgage you can expect the lender to make a credit inquiry. Web Hard inquiries can usually take up to five points off your FICO score and 510 points off your VantageScore credit score but the effect only lasts 36 months. However with the most-used FICO model all inquiries within a 45-day period are considered as one inquiry.

Web Hard inquiries are seen by credit scoring systems and can cause you to have a lower score but not always. On average consumers with lower numbers of hard credit inquiries have higher credit scores. Web Conduct applications in a short time frame.

To keep track of hard inquiries check. Score 732 - 16 inquiries 3 within the last year thought there was only one but there are 3 most of these inquires are rate shopping for a Auto. Compare the Best Mortgage Lender that Suits You Enjoy Our Exclusive Rates.

Even if you have multiple hard inquiries on your report in a short period you. Ad Release from a Lien on the Property. Web How many inquiries is too many for mortgage.

Apply See If Youre Eligible for a Home Loan Backed by the US. Ad Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Your credit score and other details can influence the approval.

However with the most-used FICO model all inquiries within a 45-day period are considered as. Compare More Than Just Rates. Having a lot of.

Web A bank or lender makes an inquiry. Web How many hard inquiries is too many. Most credit scoring models will lump multiple inquiries for mortgage auto or student loans together if they are made.

Create Your Discharge of Mortgage Form at No Cost. Completed by You in 5-10 Minutes. Web A single hard inquiry can shave up to 5 points off your FICO score.

Home Loans With Bad Credit What You Need To Know

How Many Hard Credit Inquiries Is Too Many Tally

Does Applying With Multiple Mortgage Lenders Affect Credit Score

How Many Hard Credit Inquiries Is Too Many Tally

Do Multiple Hard Credit Inquiries In 30 Days Count As One Rategenius

How Many Hard Credit Inquiries Is Too Many Tally

Credit Report Inquiries Letter

How Mortgage Inquiries Affect Fico Scores Credit Sesame

Understanding Hard Inquiries On Your Credit Report Equifax

How Many Points Does A Hard Inquiry Affect Your Credit Score

Does Having Multiple Credit Inquiry For Mortgage Hurt Your Credit Score Quora

How Many Times Can You Pull Credit For Mortgage Guild Mortgage

Letter Of Explanation For A Mortgage Template And How To Write One Credible

How Many Credit Inquiries Hurt Your Score Creditninja

Multiple Mortgage Credit Pulls Counting As Separate Hard Inquiries R Personalfinance

Free Letters Of Explanations For Credit Inquiries Lovetoknow

How Many Hard Inquiries Is Too Many And How To Remove Them Self Credit Builder